irs income tax rates 2022

What Is the Applicable Federal Rate AFR. Tax brackets for income earned in 2022 37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950 431900 for.

2022 Income Tax Brackets And The New Ideal Income

Your bracket depends on your taxable income and filing status.

. The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday. 1 day agoSouth Carolina lawmakers approved the rebate program as part of the state budget in June. The highest tax rate for United States federal taxes is 37 which applies to the top income earners while the lowest IRS tax rate is 10 - see the details below.

Knowing your tax bracket can help you estimate the amount of tax youll owe the IRS. To claim tax credits for energy-efficient home. 10 12 22 24 32 35 and 37.

For example if youre single with a taxable income of 40000 in 2022 you qualify for the 0 rate on long-term capital gains for that tax year. It is increasing by 900 to 13850 for single taxpayers and by 1800 for married couples to 27700. There are seven tax brackets the IRS adjusts each year for inflation.

1 day agoStarting in 2023 the Inflation Reduction Act will replace the 500 lifetime limit with a 1200 annual limit for the tax credit. 25 rows Each month the IRS provides various prescribed rates for federal income tax purposes. The standard deduction will also increase in 2023 rising to 27700 for married couples filing jointly up from 25900 in 2022.

2022-19 92622 a couple tried to deduct a six-figure loss against ordinary income based on the language in the tax return instructions. The rebate amount is based on taxpayers 2021 tax liability and is capped at 800. For heads of household the 2023 standard deduction will be 20800.

35 for incomes over 215950 431900 for. 7 rows The federal tax brackets are broken down into seven 7 taxable income groups based on your. In a new case Powell TC Sum.

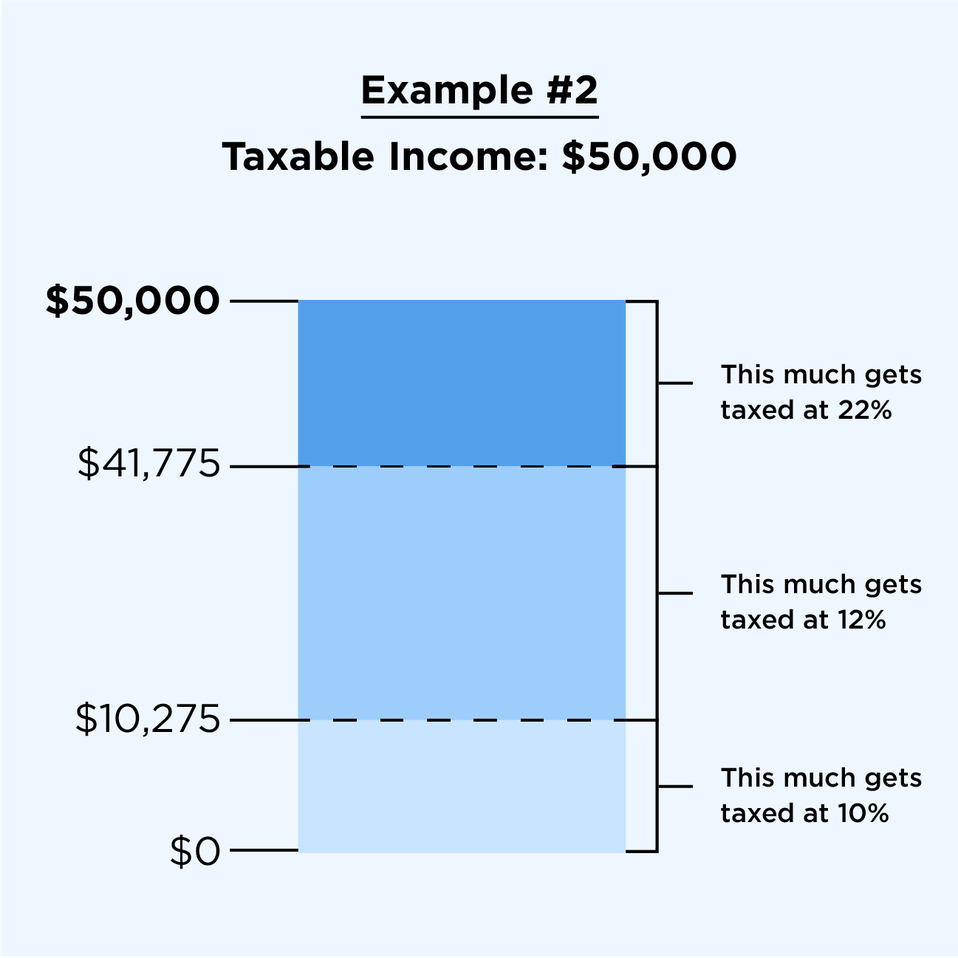

Whether your taxable income is 40000 a year 400000 or 40 million the first 10000 you earn is taxed the same 10. 8 rows There are seven federal income tax rates in 2022. Federal income tax rate table for the 2022 - 2023 filing season has seven income tax brackets with IRS tax rates of 10 12 22 24 32 35 and 37 for Single.

These are the rates for. If your income grew by 5. 10 percent 12 percent 22 percent 24.

The same goes for the next 30000 12. 25900 in 2022 20800 if your tax-filing status is head of household. Single filers may claim 13850 an increase.

Below are the new brackets for 2022 for both individuals and married couples filing a return jointly according to the IRS. Those earning between 13900 and 215400 are subject to marginal tax decreases as the corresponding rates decreased from 59 percent and 633 percent to 585. The seven tax rates remain unchanged while the income limits have been.

1 day agoThe popular federal income tax break and tax brackets will rise by more than usual due to high inflation. There are seven federal tax brackets for the 2022 tax year. The IRS in Revenue Ruling 2022-22 has issued the various prescribed rates for federal income tax purposes.

2021 2022 Tax Brackets And Federal Income Tax Rates

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

How Do Federal Income Tax Rates Work Tax Policy Center

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Federal Income Tax Brackets For 2022 And 2023 The College Investor

2022 Federal Tax Brackets Tax Rates Retirement Plans Western States Financial Western States Investments Corona Ca John Weyhgandt Financial Coach Advisor

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

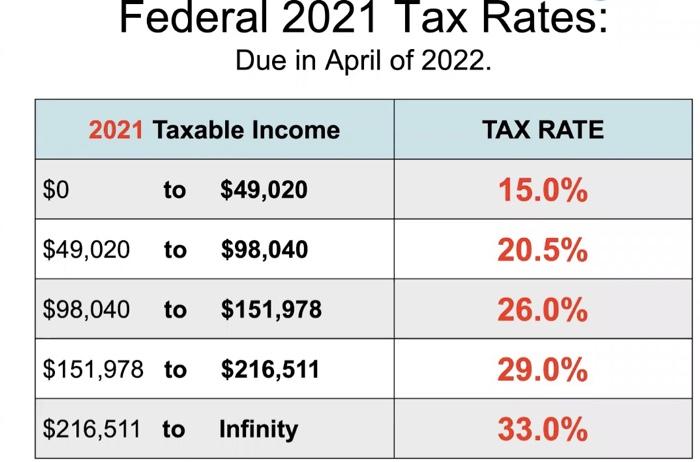

Solved Federal 2021 Tax Rates Due In April Of 2022 2021 Chegg Com

2022 2023 Federal Income Tax Brackets Tax Rates Nerdwallet

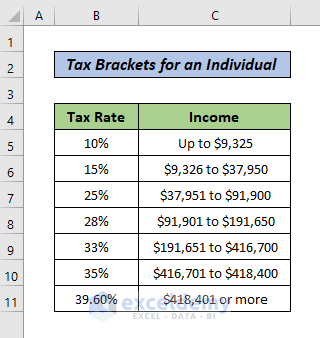

How To Calculate Federal Tax Rate In Excel With Easy Steps

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

What Is The Corporate Tax Rate Federal State Corporation Tax Rates